Tax Tools & Compliance

You likely need to pay “nanny taxes” if you are employing full-time or part-time workers in your home.

Isn’t my household hire considered a (1099) Independent Contractor?1

No. A worker is your employee if:- You have the right to control the work schedule

- What will be done

- How it will be done

- Where the work is done

- They control their work environment, including schedule and what will be done

- They set the fee

- They provide their own tools, equipment, and supplies

- They are free to have other individuals perform some of all of the services without client approval

- They are responsible for their own payroll taxes

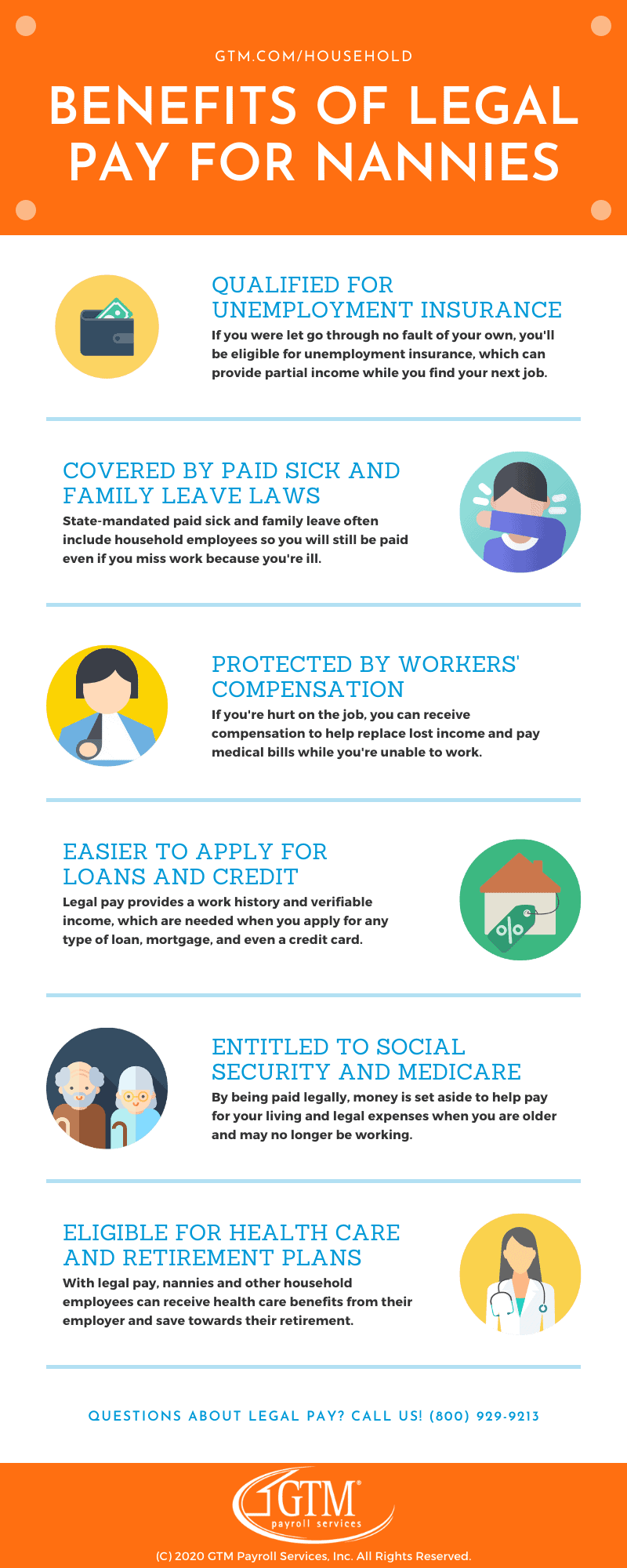

Benefits of Domestic Employment Law Compliance2

1. Attract Higher Quality Candidates When you hire a nanny or other household employee, you’re bringing a professional on board. They expect the same benefits and protections of being paid legally afforded to those who work in an office, retail store, restaurant or other type of workplace. By doing payroll and taxes the right way, you’ll pick from a larger pool of qualified candidates and have a better chance of finding the right fit for your family.

2. Work with a Happier Employee Your employee will appreciate the benefits and protections of being paid legally. They have a verifiable income and legal employment history when applying for a loan, credit card or subsidy in the health insurance marketplace. Also, you and your employee will be paying into their Social Security and Medicare accounts. By treating them like a professional, they have higher job satisfaction. This leads to a happier family (especially the kids if you’re hiring a nanny!) and an easier work relationship with your employee.

3. Gain Financial Protections Workers’ compensation insurance may be required for household employers in your state. The proper coverage ensures that some of your employee’s medical costs and lost wages will be covered if they become ill or are injured on the job. Without it, your employee can sue you for lost wages if they are hurt on the job and you don’t have the required coverage.

4. Avoid State and Federal Fines and Penalties It’s easy to get caught paying under the table. All it takes is your employee filing for unemployment after you part ways and listing you as their previous employer. They’ll be denied benefits and you’ll come under scrutiny for not paying the proper taxes. Or, your employee is injured on the job and goes to the emergency room. When they are asked how it happened, they mentioned it was at work. The injury will be reported to your state’s workers’ compensation board, which means you’ll receive a hefty fine because you’re noncompliant and don’t carry the required insurance coverage.

5. Reduce the Risk of an Audit Once the federal government realizes you haven’t been compliant with household employment law, your chances of being audited skyrocket. The audit could just be a hassle if you’re not hiding anything else. However, you’ll likely need to pay back taxes or a fine for paying your nanny “off the books.” According to The Motley Fool, failing to pay employment taxes can cost on average $25,000 in penalties and interest.

6. Take Advantage of Tax Savings Your employer’s Flexible Spending Account and/or Dependent Care Assistance Program and the federal Child and Dependent Care Tax Credit can cover some of the qualified expenses associated with being a household employer.

7. Enjoy Peace of Mind All of these benefits lead to one major advantage … peace of mind. You’ll have a solid relationship with your employee and financial protection. You won’t have to concern yourself with fines, penalties, audits or lawsuits. Even if you are audited for an unrelated matter, you won’t have to worry about household employment raising red flags.

- ©2021 HomeWork Solutions, “Independent Contractor”

- ©2021 GTM Payroll Services, “The Complete Nanny Tax Guide”

- As of 2023